FundingSmiths

Your capital toolkit from £25k to £20m

Your capital toolkit from £25k to £20m

Asset Purchases

Frequently, we see established businesses building up assets on their balance sheet from commercial premises and equipment through to software systems and intellectual property. As well as helping fund these assets strategically, FundingSmiths has seen these activities contribute towards revenue generation and business valuation over time.

Product Development

Tech driven businesses have an edge when it comes to improving their product and service offerings in their niche markets. This is a critical way of growing brand appeal and developing a loyal customer base. Equally, it’s a great way for SMEs to claim tax rebates on innovative solutions.

Supply-Chain

With the goal of improving our clients’ relationship with their suppliers, FundingSmiths actively helps small businesses by raising capital that satisfies purchase orders early, meet customers’ demand faster and maximise their purchasing power. This opens up even more doors to domestic and international opportunities, ultimately increasing sources of revenue.

Training and Recruitment

Hiring well and investing in the right people is key for commercial success. This is one of the frequent reasons businesses approach FundingSmiths is to help invest in staff technical know-how. The aim is to deliver better services to end-users and ultimately improve customer retention. This approach is the making of forward-thinking businesses.

Partner Buyout

Buying out an existing partner is often complicated by personal factors due to retirement, disability, death, partner dispute or even the desire to simply part ways. In these scenarios, FundingSmiths help facilitate a clean slate for partners looking to take over a business. This allows them to take control of the company’s direction, reduce their liabilities and increase their profit share in the long run.

Acquisitions

Speaking of acquisitions via MBOs / MBIs, FundingSmiths doesn’t just consider profit-making companies: our support also extends to acquirers at a pre-profit stage. If your business can demonstrate good strategies of how to incorporate a target business, then we can support acquisition plans. This is a move that can attract talent, increase market share and build a bigger customer base.

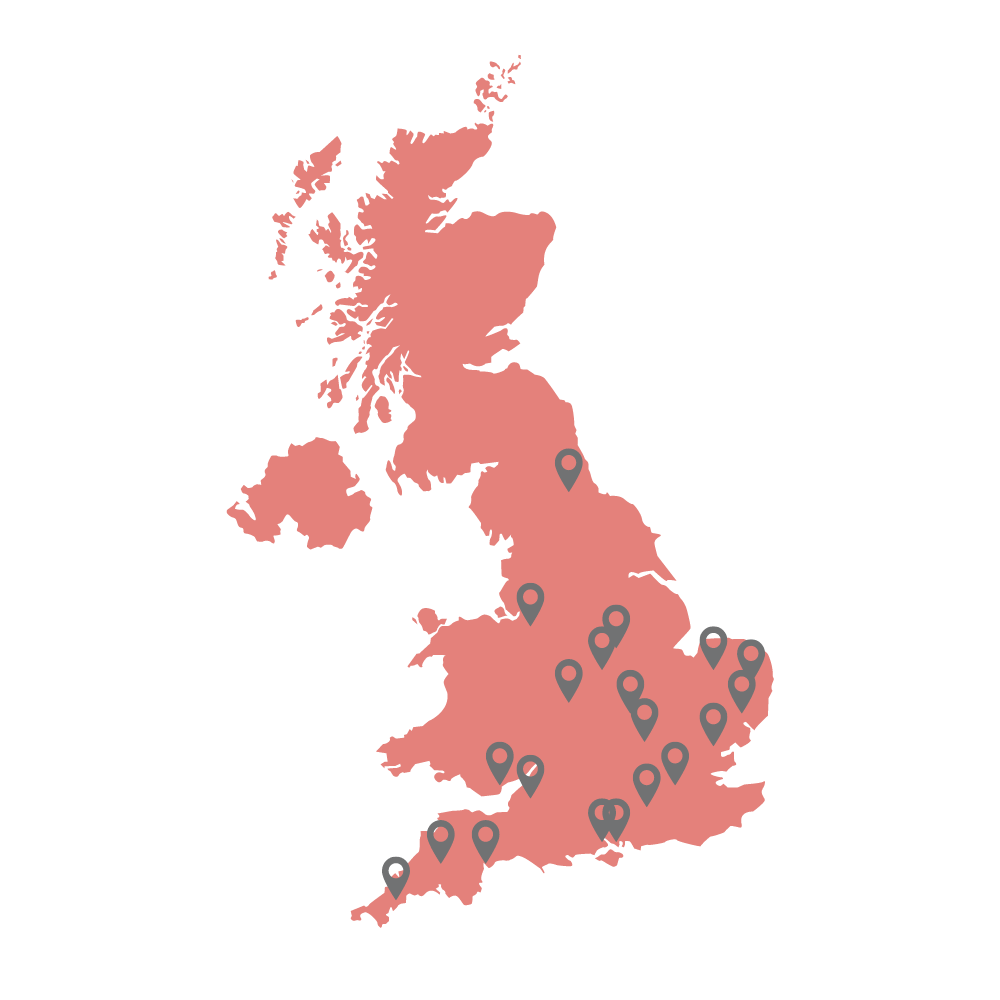

London

Norwich

Norfolk

Ipswich

Portsmouth

Exeter

Southampton

Nottingham

Cardiff

Birmingham

Cheshire

Essex

Northampton

Milton Keynes

Surrey

Bristol

Durham

Cornwall

Devon

Leicester

Become a FundingSmiths client today

Become a FundingSmiths client today

Personal Guarantee Insurance (PGI) involves more than just signing your name off on the dotted line when your business secures a commercial lending facility. In case your debt obligations are not met, a personal guarantees insurance (PGI) is there to protect your personal assets.